About the guide

This guide is for business leaders, sustainability managers, board members and employees who want to reduce the emissions from their company’s cash holdings – a critical yet overlooked driver of corporate greenhouse gas emissions.

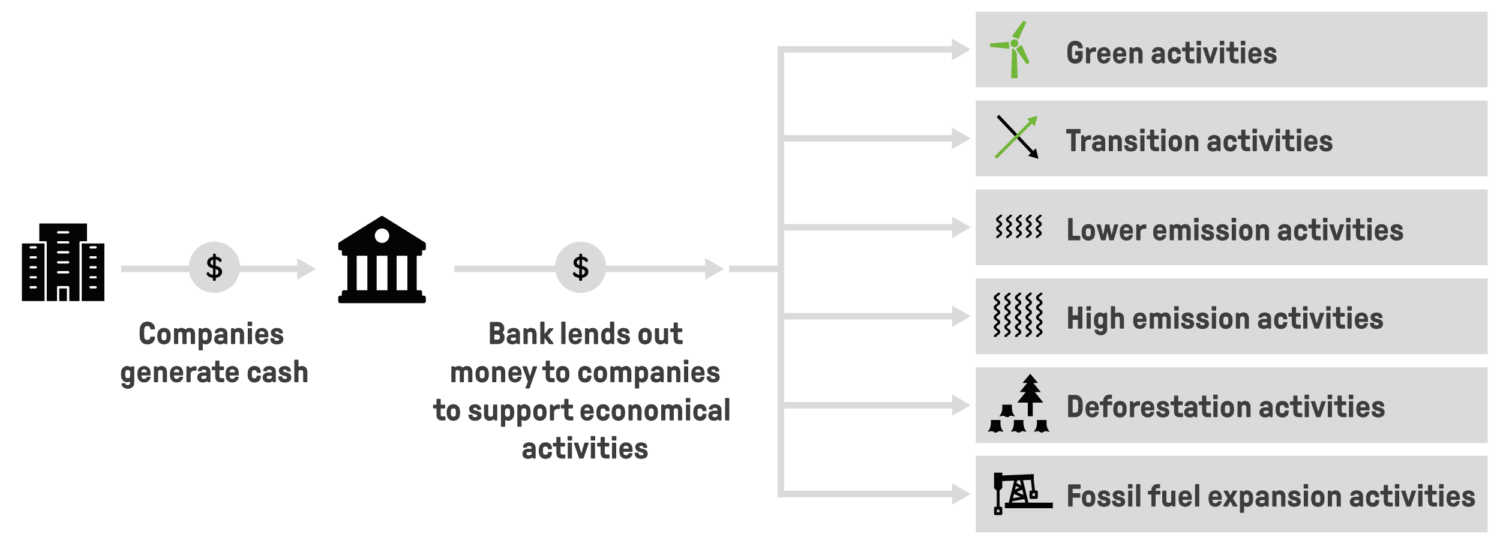

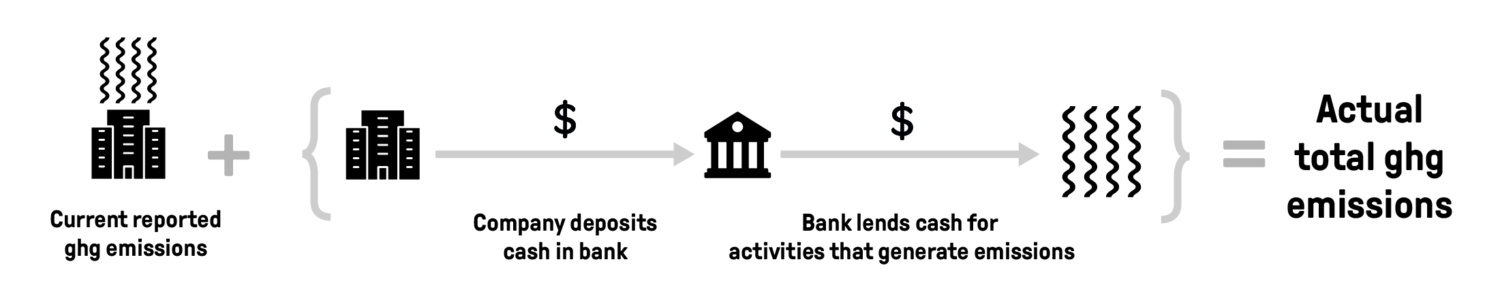

Every organisation has a financial supply chain similar to its material supply chain. The financial supply chain includes suppliers of financial services such as cash management. Just as the material supply chain, the financial supply chain also generates emissions. These arise from how banks use a company’s money to finance activities that generate emissions.

For many companies, their total greenhouse gas emissions would be significantly higher if emissions from cash holdings in the bank were counted. However, these emissions are currently not quantified or reported in corporates’ greenhouse gas accounting.

Actioning the 1.5 °C Business Playbook

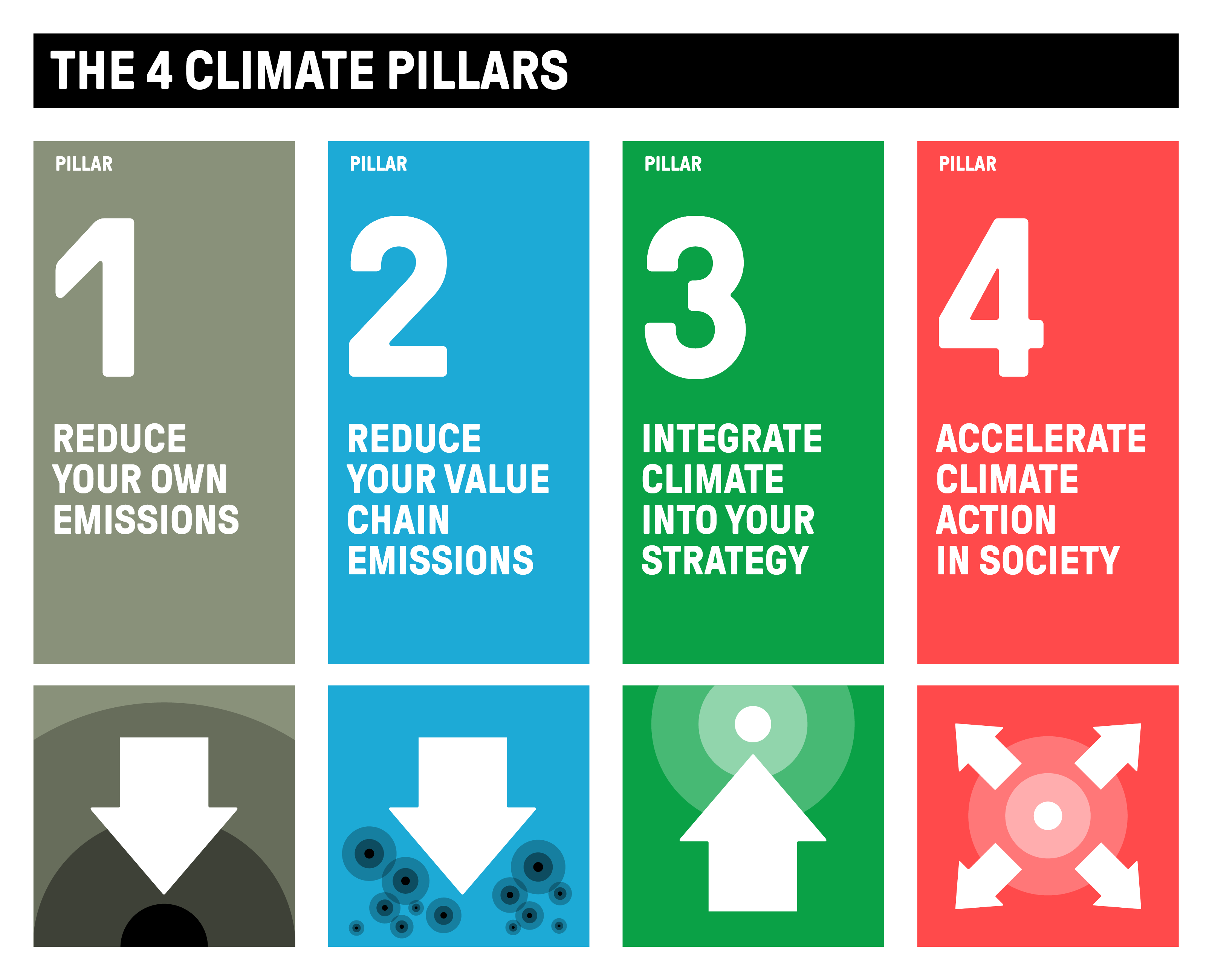

The 1.5°C Business Playbook sets out a four-pillar climate strategy focusing on four pillars that need to be addressed in a company’s climate strategy to align with the 1.5 °C ambition.

Pillar 2 focuses on a company’s activities to reduce its value chain emissions.

One such activity is to evaluate and take action to reduce the footprint of the company’s financial supply chain. The Greening Cash Action Guide lays out how to do that.

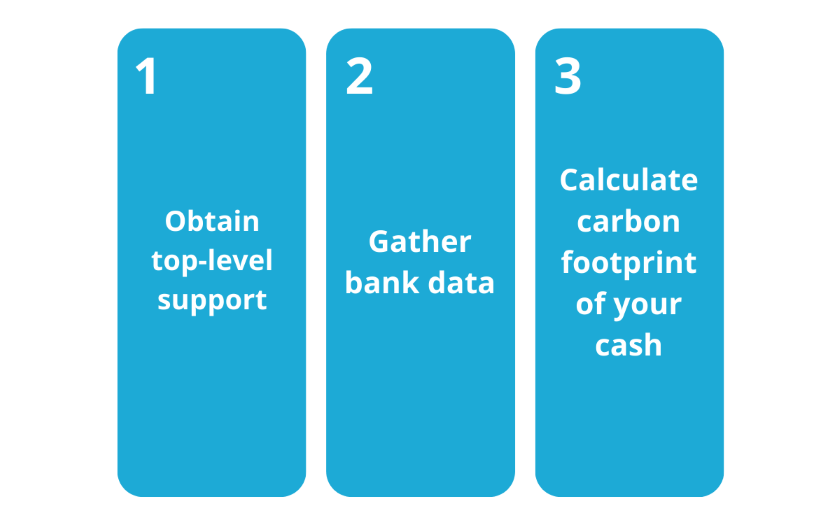

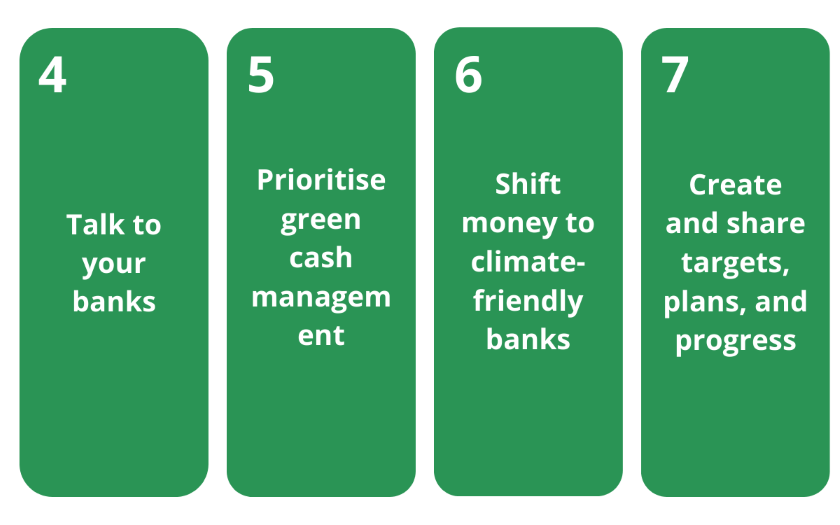

Seven key actions to start greening corporate cash

This guide shows that companies can take actions to reduce the emissions related to their cash holdings. They will face challenges, partly because of the evolving regulatory landscape for financial institutions and partly because banks rarely provide the financial emissions data that companies require to fully measure the emissions financed by their corporate cash.

Despite these challenges, action is possible and can help drive the transformation towards a more sustainable financial sector.

What others say about the Greening Cash Action Guide

Greening cash to set in motion a virtuous cycle

By action on the guide, companies can reduce emissions from their cash holdings in the bank. They also send an important signal to their banks, potentially setting in motion a virtuous cycle in which companies and banks put stricter requirements on each other, accelerating the decarbonisation of the financial system.

Accelerating Greening Cash Action

Our mission is to accelerate exponential climate actions and solutions. If the Greening Cash Action Guide sparked your interest to talk further about actions to green corporate cash and support the decarbonisation of the financial system, drop us a line.

Latest news

Urgent for Nations to Press Pause on Deep Seabed Mining

As the race for minerals intensifies, the deep sea—one of Earth’s most mysterious and fragile ecosystems—finds itself in the crosshairs. As governments meet at the International Seabed Authority Assembly this week, the conservation of our planet’s most pristine ecosystem, the deep sea, must be a paramount priority writes Johan Falk (ERI) and Jessica Battle (WWF).

From targets to transition: How NDCs can help align ambition between governments and business

As countries prepare to update their national climate targets ahead of COP30, the Exponential Roadmap Initiative, together with IKEA and Unilever, is working to ensure these targets are actionable and aligned with what businesses need to drive real progress. Listen to a timely conversation from the SB62 gathering in Bonn.

New report: World must halve emissions every five years to stay close to 1,5 degrees

Starting in 2025, the world must halve emissions by 2030 to limit global warming close to around 1.5°C. This proposed trajectory means emissions need to drop around 12 percent per year, according to a new analysis by Klimatkollen, in collaboration with Exponential Roadmap Initiative.